Contents:

Notice that the open and close prices of candlestick two are almost equal, and the pattern ends more than halfway up the red stick that kicked it off? All four conditions present in the morning star structure are valid here as well. The evening star, on the other hand, has the same structure and it is also a reversal pattern. Unlike the morning star, the evening star occurs at the top of an uptrend and it signals a potential change in the price direction.

Bears were unable to continue the large decreases of the previous day; they were only able to close slightly lower than the open. The opposite occurring at the top of an uptrend is called an evening star. You first confirm the Doji Morning Star and look at the MACD histogram and the signal line.

Open Account

Before we understand the morning star pattern, we need to understand two common price behaviours –gap up opening and gap down opening. A daily chart gap happens when the stock closes at one price but opens on the following day at a different price. Identifying these candlestick patterns is an essential tool for every trader. By understanding these patterns, traders can better navigate the market and make more informed trading decisions.

Commodity.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. The bulls then took hold of the Midcap 400 exchange traded fund for the entire day. However, Day 2 was a Doji, which is a candlestick signifying indecision.

Nevertheless, before taking any https://trading-market.org/, it is critical to wait for confirmation of the information. The formation of a Morning Star pattern typically occurs near the end of a downward trend in the market, and it is indicative of a possible shift in the market’s direction. The information provided herein is intended for general circulation.

What is the Doji Morning Star Candlestick Chart Pattern?

An integral component of a technical trader’s toolkit is the morning star and evening star patterns. Morning and evening star forex patterns are very similar to each other. This example also shows an increase in volume during the formation of the morning star pattern, which confirmed the pattern and increased the odds that a bullish reversal was highly probable. During the formation of the three candlesticks that make up this pattern, traders want to see volume increasing with the most volume present after the close of the third green candlestick. This acts as additional confirmation that price is getting ready for a reversal.

The star does not need to form below the low of the first candlestick and can exist within the lower shadow of that candlestick. The star is the first indication of weakness as it indicates that the sellers were not able to drive the price close much lower than the close of the previous period. This weakness is confirmed by the third candlestick, which must be white or light in color and must close well into the body of the first candlestick. A price upswing’s peak, where evening star patterns first appear, is bearish and indicates that the uptrend is about to end. The morning star forex pattern, seen as a bullish reversal candlestick pattern, is the opposite of the evening star pattern.

A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend. Now, to increase the chances of success, you can also combine a volume indicator with the Doji Morning Star pattern. Here, in the EUR/USD chart, you can see how increasing trading volume at the exact time of the formation of the Doji morning star provides another signal to enter a buying trade. The RSI is one of the most widely used and popular technical analysis indicators. It indicates overbought and oversold levels and can tell key divergences in price action. Moreover, combining the indicator with the Doji Morning Star adds a confluence in that anticipated move and confirms the direction of the trend.

What Is a Morning Star?

Trading coaches Meet the market trading coach team that will be providing you with the best trading knowledge. Allen and his team of professionals are actively working together to help the average retail trader become successful and profitable in the market. The performance quoted may be before charges, which will reduce illustrated performance. If you found value in this guide, give it a share on social media and help other like-minded traders get help too. Personally, they are not the first thing I look for but when I do see them appear – you can bet your house that I’m going to take a potential trade from it.

- As you can see in the example above it’s compact, if the lows are lower or the highs are higher, then this is not a morning doji star.

- The stop loss for the trade will be the highest high of P1, P2, and P3.

- The evening star is considered a bearish reversal pattern and can be used to enter short positions or exit long positions.

- SFP is also both Derivatives Trading and Clearing member of the Singapore Exchange (“SGX”).

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.17% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should know how to identify a downtrend if you are reading around candlestick patterns, so I’m not going to go into that. The Morning Star pattern can be seen as an indication that the bearish trend is over and a bullish trend will begin.

Morning Star Candlestick: Identification Guidelines

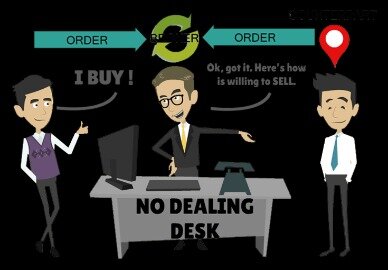

An increase in volume frequently follows large market changes and might lend credence to the argument that a trend is shifting in the other direction. The typical method to trade a morning star is to open a buy position once you have confirmed that a bull run is actually underway. If you don’t confirm the move before trading, then there’s a chance the pattern could fail.

It should not be construed as a recommendation, or an offer to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Then in candlestick three, we have a dramatic fall, erasing more than half of the gains posted two sessions earlier. The process to trade an evening star, meanwhile, is again the opposite of a morning star. Spot an evening star with a doji instead of a spinning top in the middle?

It’s important to wait for confirmation of this signal by looking for other signs of bullish sentiment and indicators such as moving averages, MACD, and RSI to confirm. The Piercing pattern is a bullish trend reversal pattern that appears towards the end of an existing downtrend. The Piercing pattern is the opposite of the Dark Cloud Cover pattern that appears in an uptrend. It is also similar in appearance to the Trusting Line pattern. The default “Intraday” page shows patterns detected using delayed intraday data.

So this is essentially a bullish reversal pattern and can help traders enter the market at a swing low point of the trend. Reliability is also enhanced if the volume on the first candlestick is below average and the volume on the third candlestick is above average. The morning star is merely a visual representation; no calculations are required. There are other additional ways where you can see the star forming.

What is a Long Upper Shadow Candlestick and How to Trade it

Suddenly, buyers and sellers are cancelling each other out, meaning bears couldn’t maintain control of the market. Then, finally, bulls take over in the final session with a strong green candlestick. The morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks.

To be successful, traders should first practice with a demo account and conduct research to minimize risk. A candlestick chart with a long bearish candle, a short-lived bullish candle that gaps down from the first candle, and then a long bullish candle is what you want to find. Make sure the pattern is forming at the end of a downtrend or at the end of a consolidation period before trading it.

The pattern is split into three separate candles with relationships between all of them. As said earlier, the occurrence of a morning star pattern is not as frequent as those of a single-candle formation. They are harder to spot, aside from you practically needing to fulfil all four conditions before you can verify its presence. In this article, we’ll explore the characteristics of the morning star pattern, its reliability, the psychology behind its formation, and how you can analyze it using TradingView. This is a 3-candlestick pattern and is really easy and obvious to identify.

#11: What is a Morning Star

This is followed by a large white candle, which represents buyers taking control of the market. As the Morning Star is a three-candle pattern, traders often don’t wait for confirmation from a fourth candle before they buy the stock. Traders look at the size of the candles for an indication of the size of the potential reversal.

We are recommending sell on rise strategy in Nifty; support seen at 17,250: Ashish Katwa – The Economic Times

We are recommending sell on rise strategy in Nifty; support seen at 17,250: Ashish Katwa.

Posted: Sat, 11 Mar 2023 08:00:00 GMT [source]

Gordon Scott has been an active investor and technical analyst or 20+ years.

It is the opposite version of the Evening Star candle pattern that appears at the end of an uptrend and signals a bearish trend reversal. The colors of the candlesticks that constitute the Engulfing pattern are quite important. When the Engulfing pattern appears at the end an uptrend, it is a bearish reversal signal and indicates a weakness in the uptrend and when the pattern appears … The Engulfing pattern is a trend reversal pattern that can appear at the end of an uptrend or at the end of a downtrend. The first candlestick in this pattern is characterized by a small body and is followed by a larger candlestick whose body completely engulfs the previous candlestick’s body.

2 stock ideas — one with a short-term up move, second with sideways option strategy – The Economic Times

2 stock ideas — one with a short-term up move, second with sideways option strategy.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

When trading the morning star pattern, there are possibly two ways to enter a trade. The first method is to wait for the pattern’s third candle to close before establishing a long position on the following candlestick. The second method is to set a stop-loss order below the low of the third candle in the pattern. The morning star forex pattern is thought to be more bullish than the evening star pattern, even though both patterns are thought to be reversal patterns. A bullish candlestick pattern known as the morning star forms when there is a downward trend.

As a rule of thumb, the higher the number of evening star dojis involved in a pattern, the better it is to initiate the trade on the same day. The expectation is that the bullishness on P3 is likely to continue over the next few trading sessions, and hence one should look at buying opportunities in the market. After the gap down opening, nothing much happens during the day resulting in either a doji or a spinning top.